You’ve probably noticed one thing if you’re thinking about making a move: the housing market feels a bit unpredictable right now. The truth is, from home prices to mortgage rates, we’re seeing more volatility – and it’s important to understand why.

At a high-level, let’s break down what’s happening and the best way to navigate it.

What’s Driving Today’s Market Volatility?

Factors like economic data, unemployment numbers, decisions coming out of the Federal Reserve (The Fed), and even the presidential election, are creating uncertainty right now – and uncertainty leads to market volatility.

You can see that when you look at what’s happening with mortgage rates. New economic reports and other geopolitical events have an impact and can cause sudden shifts up or down, even though experts still forecast rates will come down overall. We’ve seen that effect play out recently, like when employment and inflation data get released each month.

And as the markets react, these types of updates will continue to have an impact on rates moving forward. As Greg McBride, CFA, Chief Financial Analyst at Bankrate, says:

“After steadily declining throughout the summer months, I expect more ups and downs to mortgage rates . . . Job market data will be closely watched as well as any clues from the Fed about the extent of upcoming interest rate cuts.”

This is exactly why the projected decline in mortgage rates isn’t going to be a straight line down over the next year. As Hannah Jones, Senior Economic Research Analyst at Realtor.com, explains:

“Rates have shown considerable volatility lately, and may continue to do so . . . Overall, we still expect a downward long-term mortgage rate trend.”

Plus, home prices and the number of homes on the market vary dramatically depending on where you’re looking to buy or sell, which makes it even harder to get a clear picture. In some areas, home prices are rising and inventory is tight, while in others, there are more homes available and it’s leading to more moderate pricing shifts.

As all of this unfolds, understanding what’s happening will help you make the right decisions, whether that’s buying or selling. And there’s one easy way to get that information: from a professional.

The Importance of Partnering with a Pro

While the road ahead may have some bumps and unexpected turns, you don’t have to go it alone. A great agent will keep you up to date on the latest market developments, guide you through any shifts, and help you make smart decisions based on your goals.

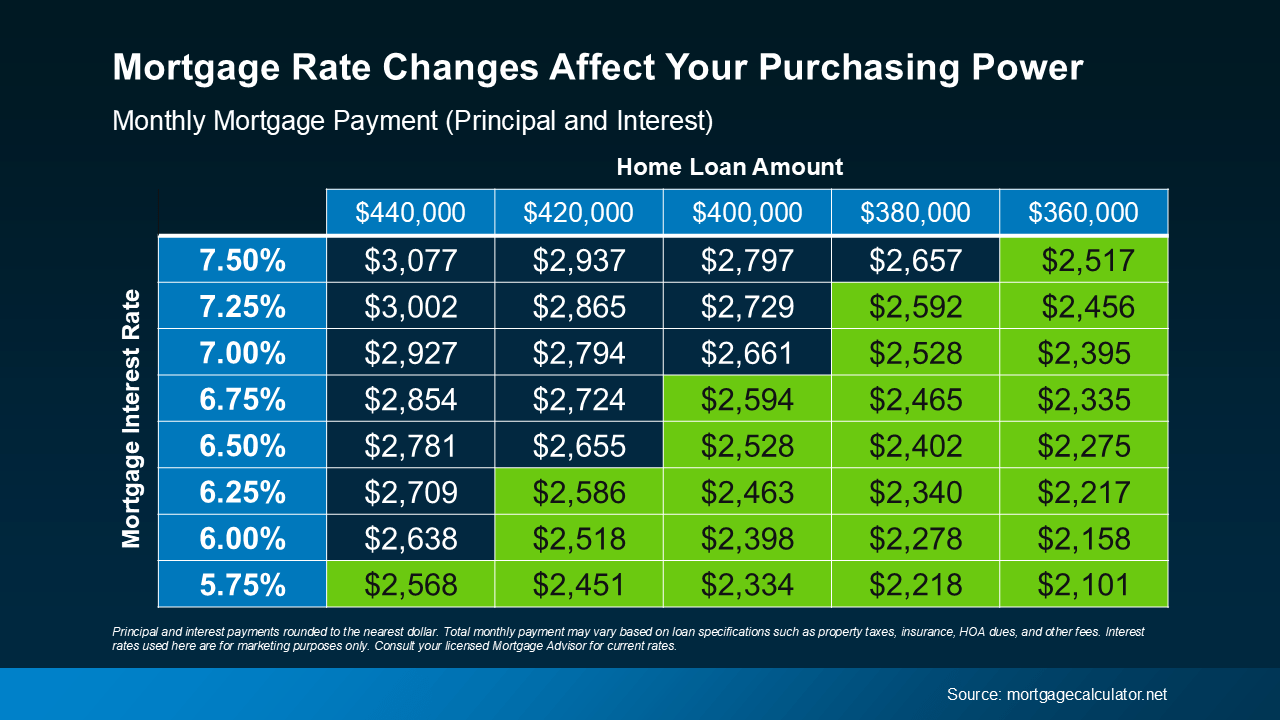

For example, as mortgage rates change, professionals (like your agent and a trusted lender) will explain how the shifts impact what you can reasonably plan for in your monthly payment. This will help you see how even a small change in rates can impact your bottom line – that way you don’t lose sight of the big picture even as shifts happen here and there.

And since conditions can vary significantly from one neighborhood to another, your agent will also help you understand the specifics of your market—whether it’s how to navigate competition with other buyers, the number of homes available, or what’s happening with local home prices. Their insights and expertise will help you adapt to any movement in the market.

Bottom Line

The housing market may be experiencing some shifts, but don’t let it stop you from making your move. With the support of an experienced real estate agent and a trusted lender, you’ll be ready to navigate the changes and make the most of the opportunities that come your way.

Let’s turn any uncertainty into your advantage, helping you move forward with confidence.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link